VetForum Europe 2024 was held in May in Sitges, Spain (about 35 kilometers southwest of Barcelona). To say it is a beautiful area would be an understatement.

Of course, it wasn’t all play—there were networking sessions, meetings, and forward-thinking discussions. I teamed up with Candise Goodwin, founder of Outlier Advisors, to offer insights into the U.S. pet health market.

Along with information about the current U.S. market landscape, market trends, and top players, we offered strategic recommendations about market entry fundamentals and planning for success. Namely:

- Tech Integration – Cutting-edge technology and streamlined operations

- Innovative AI Solutions – For personalized pet care services and client engagement

- Workforce Optimization – To enhance operational efficiency and mitigate staffing issues

- Market Tailored Offerings –g., telemedicine, mobile vet services, specialized products

- Strategic Partnerships – Collaborate with pet care providers and industry influencers

In addition to our session, I hosted a panel discussion on harnessing the power of technology to drive revenue and enhance the client experience. The panel members (Thom Jenkins, Co-Founder & CEO at PetsApp; Paul Ebert, Founder & CEO at Tabeo; Matthew Bubear, Founder & Chief Vision Officer at CASCO Pet; and Randy Valpy, CEO at Fear Free) presented insights into what is changing in the pet market space.

The panel discussed how technology is improving workflow for the team (leading to a better work-life balance), driving efficiencies, and increasing profitability. The integration of AI has led to more effective customer interactions through chat and email, and even triage processes are benefiting from AI utilization. In addition to technology, the demographics of both humans and pets are changing. There is a decline in the excess COVID pets, the economy is impacting discretionary spending on pets, and clients are showing some reluctance to purchase pet insurance for middle-aged and senior pets due to premium costs. It is becoming more popular among pet parents to conduct DNA testing for their pets (of all ages and breeds) and to provide personalized medicine for them.

In his session, “State of the Nation: M&A Trends in the EU Animal Health Space,” Matthew Lee, Co-Head Of Healthcare, Europe at Lincoln International, provided global insights, including a message about the resilient Veterinary profession.

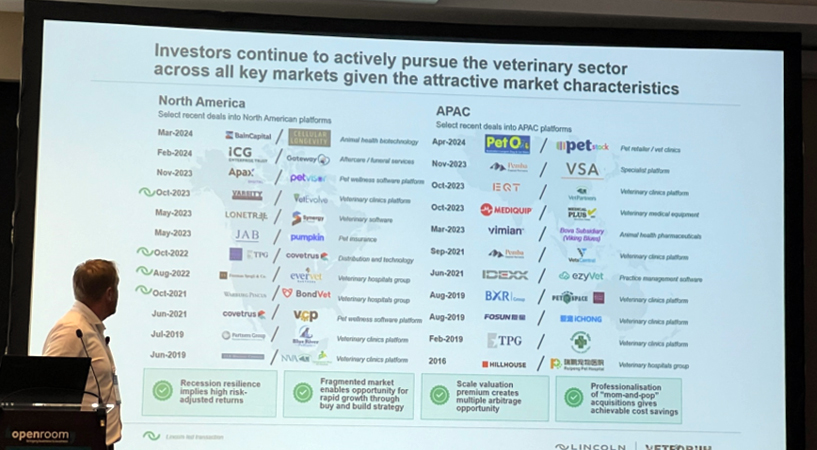

The global market is slowing (not just in the U.S.). Rising costs of living, declining pet populations, slowing M&A, and increasing Veterinary practice prices are common factors impacting the industry. In his message to the industry, Matt urged companies to focus on revenue growth and pay attention to cash flow programs and operating expenses. On a positive note, investors are still interested in the Veterinary sector, and the following slide details that information.

Matt also discussed the fact that COVID puppies and kittens are moving into adulthood, and the concentrated boom is over. In addition, he anticipates an eventual rise in senior care and Veterinary visits when those COVID “kids” age.

Based upon the current state of the industry, these key takeaways were drawn: Expect increasing lapsing pet owner numbers, increasing the time between Veterinary visits, and declining preventative care spending by pet parents. Matt also noted that increasing Veterinary prices will not lead to an increase in revenue.

Finally, one of VetForum’s biggest draws is the one-on-one sessions, during which attendees connect with the owners, managing directors, and procurement specialists of vet groups.

Not only do these sessions benefit suppliers, but they also provide opportunities to get innovative products and services to Veterinary hospitals around the globe. Yesterday’s networking meeting may be tomorrow’s cutting-edge technology you are buying for your hospital.

VetForum Europe, as well as its other global events, provide the ideal venue for networking and business building. Over two days, attendees made connections with over 30 practice groups representing close to 5,000 practices across Europe. Among the most valuable aspects of the meeting are the opportunities to network with Europe’s top group practice leadership teams and learn about market trends—and these trends validate those in the United States.

If you are a supplier or group practice leader, I strongly encourage you to look at their U.S. event in Austin in September (https://www.openroomevents.com/vetforum-usa-2024.php).